Form 17 Seller Disclosure Statement

Not in the mood for unpleasant surprises? There should be nothing to worry about if you ask the seller of a property to present you with a Form 17 Seller Disclosure Statement/Improved Property. Let’s take a look at what it is and why you should request it.

Who needs a Form 17 Seller Disclosure Statement (Improved Property)?

When entering into a real estate agreement, it's necessary to make sure that all legal procedures are properly followed. Besides numerous terms and conditions that the parties (a Seller and a Buyer) have to agree upon, there is one more tool that can help to avoid unexpected disappointments in a newly purchased property. The seller is typically obligated to inform a buyer of all known deficiencies using a Seller Disclosure Statement.

What is Form 17 Seller Disclosure Statement (Improved Property) for?

A Seller Disclosure Statement, or Form 17, is helpful for the Buyer in terms of learning about the seller’s experience of living in a property and understanding as much about the property as possible. To some extent, the disclosure should also play a significant role for the buyer while evaluating the property considered.

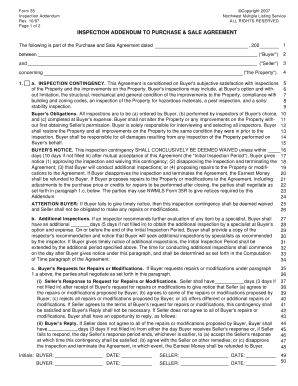

Is Seller Disclosure Statement accompanied by other forms?

The overall procedure of buying a real estate requires filling out and signing numerous legal documents, like an Offer to Purchase, Counteroffers, Sales and Purchase Agreement, etc. As for the the Seller Disclosure Statement, the need to attach supporting documents depends on the answers and comments to the provisions covered in the statement. Broadly put, if the Seller’s answer is “Yes” to any of the items that are asterisked, it is mandatory that the Seller provide an explanation on the attached sheets, or attach a corresponding documentation or disclosure.

When is Seller Disclosure Statement due?

The due date for the delivery of the Disclosure Statement is to be discussed between the parties. Unless otherwise agreed, Form 17 must be delivered to the Buyer within five business days from the conclusion of the Sales and Purchase Agreement.

How do I fill out a Form 17 Seller Disclosure Statement?

The Seller Disclosure Statement must indicate the Seller and the property being disclosed, along with the following specifications:

- Title

- Water

- Sewer/ On-site sewage system

- Structural

- Systems and fixtures

- Homeowners’ association/common interest

- Environmental

- Lead-based paint

- Manufactured and mobile homes, etc.

Each page containing information about these specifications must be signed and dated by the Seller. Also, the Seller Disclosure Statement must include Notices to the Buyer and Buyer’s Acknowledgment, which the Buyer must sign.

Where do I send a Seller Disclosure Statement?

The Seller must deliver the Disclosure Statement to the Buyer and their respective real estate agent. The Seller must also retain a copy for their files.